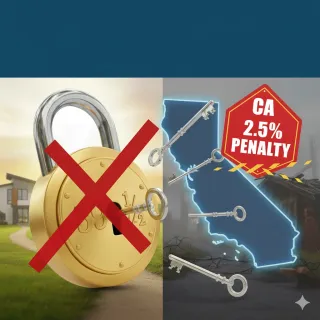

Unlocking Your Retirement Savings Before 59 ½ (And What Californians Must Know)

Thinking of tapping your retirement savings before 59 ½? The 10% federal penalty isn't the only hurdle. For Californians, there's an extra 2.5% penalty to consider. Here’s what you need to know. ...more

Retirement

September 22, 2025•4 min read

Beyond the Headlines: The Overlooked Power of Dividends in Your Retirement

Market highs and low yields have many asking if dividends still matter. Here’s why a "total return" focus—on both growth and income—is key to a secure retirement ...more

Investing

September 15, 2025•5 min read

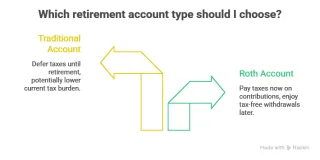

Seed or Harvest? A Strategic Guide to Roth Decisions in Retirement

The Roth vs. Traditional debate is like choosing when to pay tax: on the small seed now, or the big harvest later? Here’s how to make the right choice for you, year by year ...more

Retirement ,Tax

September 07, 2025•5 min read

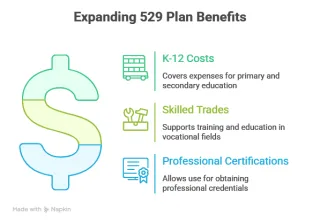

The 529 Plan Reboot: How New Rules Make It a Super-Tool for Your Family

Big news for education savings! Recent law changes have made 529 plans more flexible than ever. They can now be used for K-12 costs, skilled trades, and professional certifications. Here’s a breakdown... ...more

College ,Financial Planning

September 04, 2025•5 min read

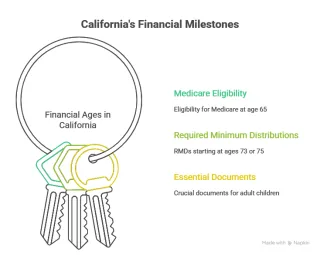

A Californian's Retirement Roadmap: Key Financial Ages You Can't Afford to Miss

Your guide to California's key financial ages. From Medicare at 65 to RMDs at 73/75, plus the crucial documents your adult kids need now ...more

Financial Planning

August 30, 2025•6 min read

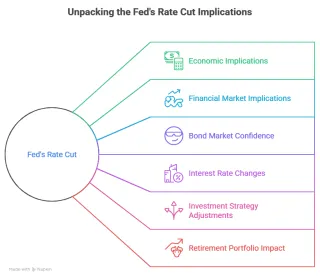

Reading the Signals: What the Fed's Next Move Means for Your Retirement

The Fed is signaling a rate cut. Find out what that means, why the bond market is showing confidence, and how it impacts your retirement portfolio. ...more

Economy

August 25, 2025•4 min read

Your trusted partner in financial growth and investment success, committed to securing your financial future.